Analyzing the Investment Performance of Retired LEGO Sets from 2022 After 60 Days

They are outperforming the stock market by a mile, who would have thought

Today’s post is brought to you by me. If you want to learn how to get started with LEGO investing, look no further than my LEGO Investing Mastery guide.

In the guide, I explain exactly how I have made tens of thousands of dollars annually by buying, holding, and selling LEGOs.

Get access to it here.

Regular readers are aware that I document the performance of my personal LEGO investment portfolio here each month.

However, that portfolio only includes a select number of LEGO sets that I chose to invest in.

What about all the other sets that retired at the end of 2022?

We’re going to take a look at them. All of them.

Investment Performance

Before I start dropping the data, there are a few things you should know:

Several sets were excluded if:

There wasn’t consistent Amazon historical data

There was no Amazon listing

It was a non-typical set like an Advent Calendar

They retired in July

After crunching all the data myself, here is what I came up with.

The Overall Average Return on Investment After Selling Fees for All Sets: 18.1%

Below is all of the data broken down by theme and set.

If either of them have an ROI above 18.1%, that means it’s over-performing. If a theme or set has an ROI below 18.1%, that means it’s under-performing.

Architecture

Average ROI After Selling Fees: 29.5%

No shock here. The Tokyo set was always going to do well long term.

City

Average ROI After Selling Fees: 12.8%

A technical underperformance, but understandable given how many sets retired.

Creator

Average ROI After Selling Fees: 13.7%

Most of these sets are low-price sets, so not a surprise to see a lower number here.

DC

Average ROI After Selling Fees: 19.7%

Why did I not invest in the Batwing? Can’t believe I spaced that one.

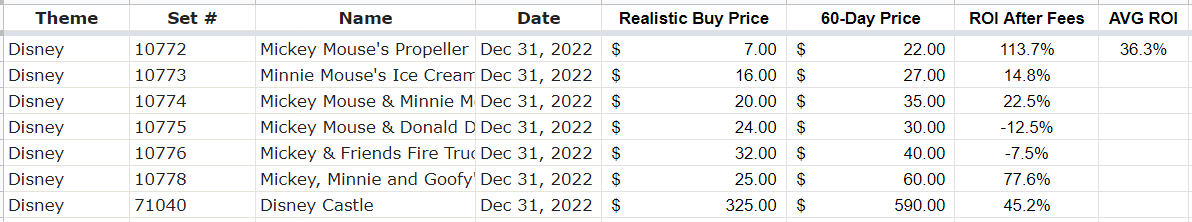

Disney

Average ROI After Selling Fees: 36.3%

I had mentioned previously that I thought Disney sets were being slept on. This is proof of that.

DUPLO

Average ROI After Selling Fees: 24.6%

DUPLO above average, like always. One day these won’t be underrated, but they still are.

Friends

Average ROI After Selling Fees: 22.4%

I expected the same performance as City here, so this was surprise. Great to see.

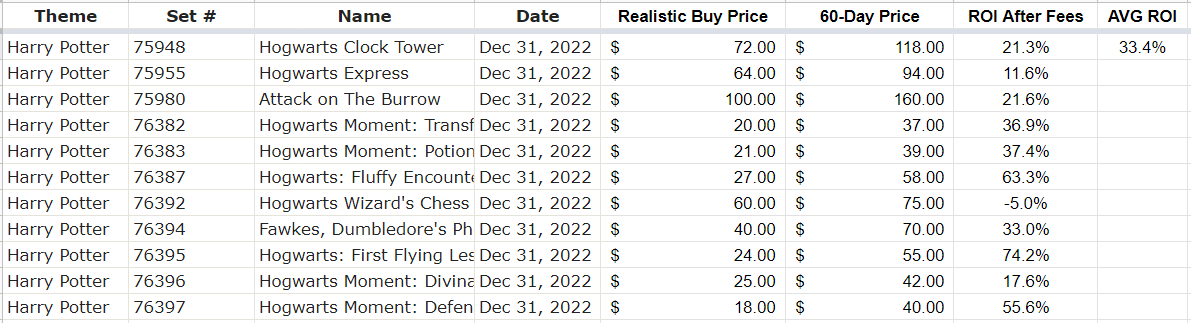

Harry Potter

Average ROI After Selling Fees: 33.4%

Is anyone shocked here? I’m not.

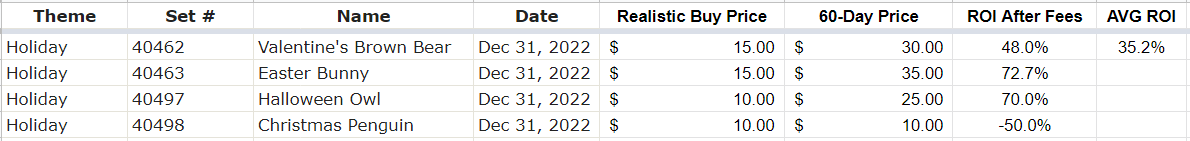

Holiday

Average ROI After Selling Fees: 35.2%

The performance looks crazy until you see the price of the sets. While lower priced sets can make a great return, you have to sell a million of them to make a lot of money.

If the set doesn’t sell like crazy, you can easily get stuck with more than you can sell in a reasonable amount of time.

This is important to consider.

Icons

Average ROI After Selling Fees: 24.6%

No shock here, the Camper Van has been a home run.

Ideas

Average ROI After Selling Fees: 30.6%

Every single set in here is over-performing.

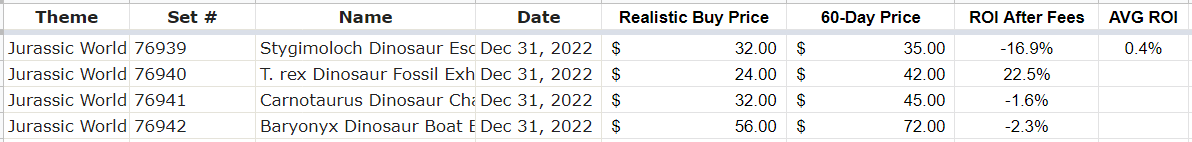

Jurassic World

Average ROI After Selling Fees: 0.4% (yikes)

I’ve been saying how I believe Jurassic World has a massive lack of demand and too much supply… this is proof.

Mario

Average ROI After Selling Fees: 10.3%

Most Mario sets suck. I’m surprised they made any money at all.

Marvel

Average ROI After Selling Fees: -1.6% (yikes)

No shock here. All the Avengers style sets are terrible. I only have a position in one of these, for good reason.

Minecraft

Average ROI After Selling Fees: 10.2%

Minecraft with poor results as usual. They make too much of this theme, supply-wise.

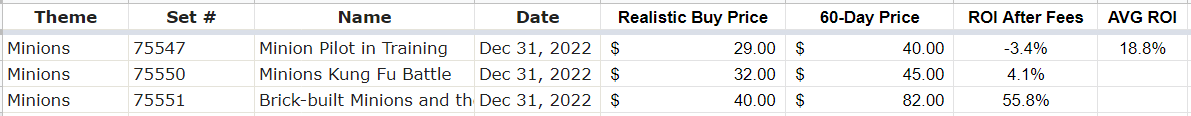

Minions

Average ROI After Selling Fees: 18.8%

As expected.

NINJAGO

Average ROI After Selling Fees: 6.8%

Disappointed to see this. I thought they’d do better. LEGO may be making too many of these… something to keep an eye on.

Speed Champions

Average ROI After Selling Fees: 7.0%

I’ve been shouting about how these sets sucked for months now. Proof is in the pudding.

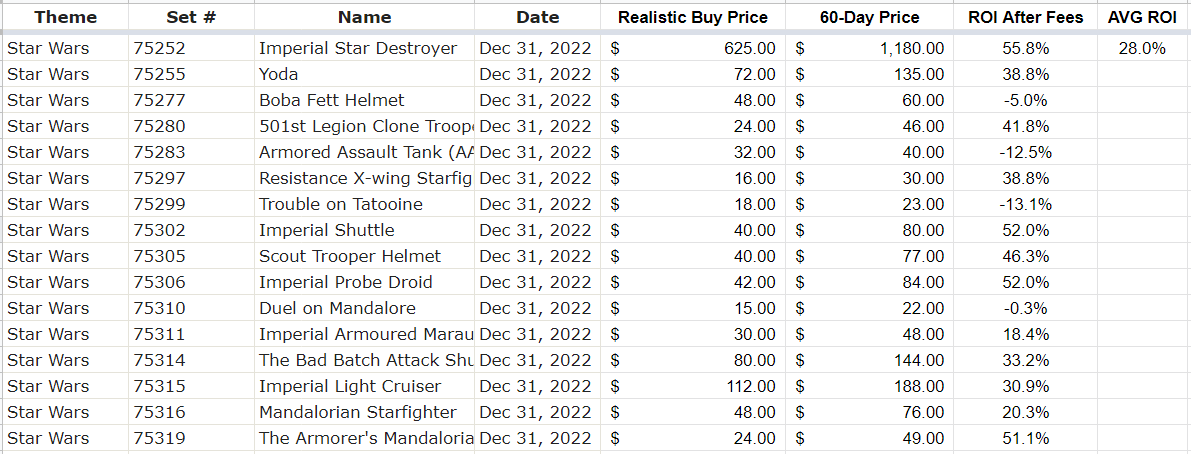

Star Wars

Average ROI After Selling Fees: 28.0%

Just like Harry Potter, are we even surprised?

Technic

Average ROI After Selling Fees: 32.9%

My favorite theme is just getting warmed up.

My Personal Portfolio

Average ROI After Selling Fees: +23.7% (as of January 31st)

My portfolio is over-performing. This means I’m choosing sets wisely, considering that I’ve already booked 7% of the portfolio’s value in profit.

Summary

Let it be known that an 18.1% return on investment after only two months is an incredible rate of return.

For emphasis, had you invested $100,000 into every set on this list evenly, you’d have $118,000 after selling them all.

That doesn’t sound like much, but if this rate of growth remained the rest of the year, that $100,000 would turn into over $200,000.

Is it likely? Probably not. Is it possible? Absolutely.

Given that my portfolio was at nearly 24% at the end of last month, I like my chances.

LEGOs remain underrated as an investment strategy and I can’t get enough of them.

If you are interested in learning how to get started with LEGO investing, consider getting my in-depth guide LEGO Investing Mastery.

These posts are not financial or investment advice.

They are made for entertainment purposes only by a bum who gave up his job as a prestigious Aerospace Engineer to talk about parking money in things like LEGOs.