Analyzing the Investment Returns of Retired LEGO Sets from 2022 After 90 Days

Had you invested $100,000, you'd now have...

This post is brought to you by me. If you want to learn how to get started with LEGO investing, look no further than my LEGO Investing Mastery guide.

In just 90 minutes, it will teach you how to outperform the stock market by buying, holding, and selling sealed boxes of LEGOs.

Get access to it here.

In case you missed it, make sure you read the 60 day update post from last month. It was originally for paid subscribers only but is now available for everyone to read.

This post and the ones like it that follow in future months will also be free to all readers.

As we close in on April, we now have 90 days of data for LEGO sets that retired at the end of 2022.

Let’s see how the different themes are performing.

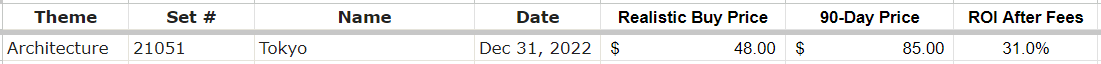

Architecture

Average ROI After Selling Fees: 31.0% (up from 29.5%)

The growth has cooled off but is also holding steady on the Tokyo set.

City

Average ROI After Selling Fees: 13.8% (up from 12.8%)

Small changes across the board but nothing crazy going on here. The Stunt sets suck and are a huge drag on the overall ROI for City.

That’s why you never saw me investing in them.

Creator

Average ROI After Selling Fees: 21.4% (up from 13.7%)

Very nice gain here over a single month. The Lion set is the only one that hasn’t made money if you invested in it.

DC

Average ROI After Selling Fees: 20.7% (up from 19.7%)

Profit taking going on with the Batwing, while other sets picked up the slack.

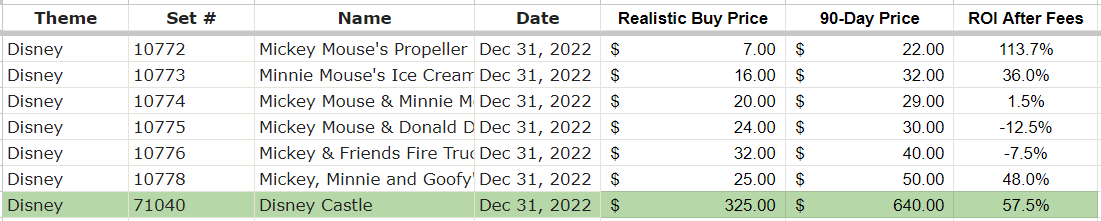

Disney

Average ROI After Selling Fees: 33.8% (down from 36.3%)

Disney cooling down a bit after a strong start. Profit taking going on with the smaller sets while the Castle set keeps climbing.

DUPLO

Average ROI After Selling Fees: 23.6% (down from 24.6%)

The Alphabet truck is now leading the way. Wishing I would have got more of them.

Friends

Average ROI After Selling Fees: 20.7% (down from 22.4%)

Some profit taking here too. Not shocking to see given how big the list of retired sets is.

Harry Potter

Average ROI After Selling Fees: 37.2% (up from 33.4%)

One of the best themes continues to perform well. No one should be surprised by this.

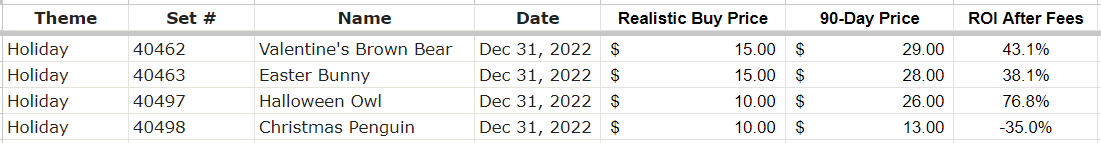

Holiday

Average ROI After Selling Fees: 30.8% (down from 35.2%)

Profit taking is becoming the theme of March, if you couldn’t tell. The more this happens, the more prices will spike heading into summer.

Icons

Average ROI After Selling Fees: 18.0% (down from 24.6%)

People who are selling now will be punching themselves when they see what happens to the Camper Van price later this year.

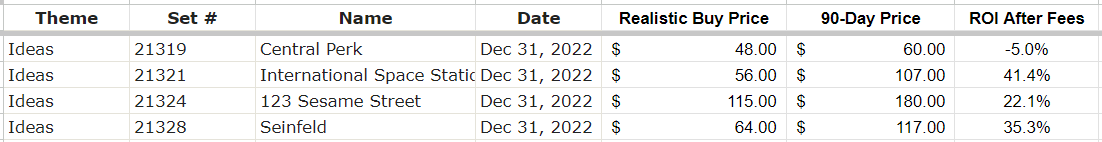

Ideas

Average ROI After Selling Fees: 23.4% (down from 30.6%)

Every set here is killing it. Central Perk price has taken a pit stop because Amazon found more of them to sell at $60.

Makes me want to add more while we still can…

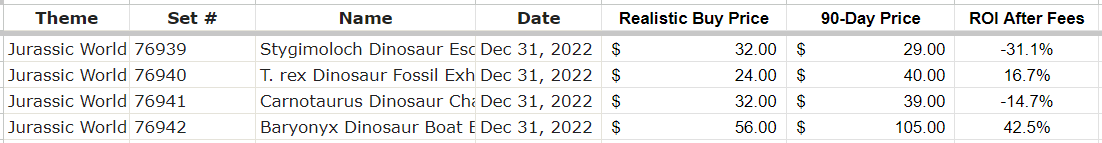

Jurassic World

Average ROI After Selling Fees: 3.3% (up from 0.4%)

The slow climb out of the gutter begins. I hope LEGO has learned that they grossly misjudged demand for these sets.

I was shouting about it for months last year.

Mario

Average ROI After Selling Fees: 11.7% (up from 10.3%)

The Mario theme continues to suck. The airship is the only good set here.

Marvel

Average ROI After Selling Fees: 3.3% (up from -1.6%)

Marvel also doing it’s best to climb out of the dumpster. All of the Avengers sets are terrible.

There is a reason I didn’t invest in any of them.

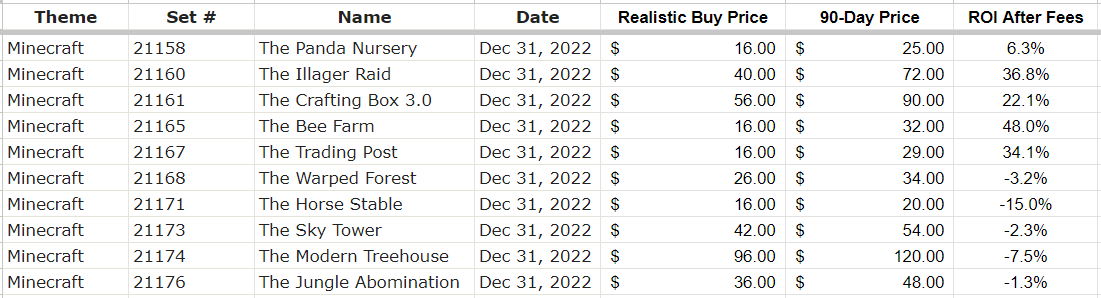

Minecraft

Average ROI After Selling Fees: 11.8% (up from 10.2%)

I maintain that the underperformance from Minecraft is either:

Kids not being as interested in it anymore

LEGO made way too much of it

It might be a combination of both.

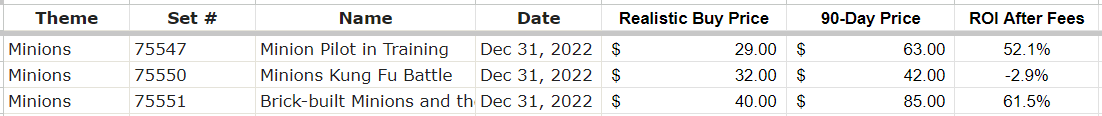

Minions

Average ROI After Selling Fees: 36.9% (up from 18.8%)

BOOM. Did I not warn that Minions was an underrated theme for investing? Go look back at previous posts.

NINJAGO

Average ROI After Selling Fees: 12.6% (up from 6.8%)

Things are slowly improving here. There is still a supply/demand mismatch within this theme though.

Speed Champions

Average ROI After Selling Fees: 9.5% (up from 7.0%)

I warned people about this theme for 2022. It was overhyped beyond belief.

Star Wars

Average ROI After Selling Fees: 37.1% (up from 28.0%)

Every set but one is profitable within Star Wars. Even the 501st Clone Troopers Set that I was skeptical about.

You can’t go wrong investing in Star Wars.

Technic

Average ROI After Selling Fees: 37.1% (up from 32.9%)

Like I said last month, we are just getting warmed up with Technic. The excavator set would be much higher by now if there wasn’t an Amazon whale dumping stock at $72.

Once that passes it will rocket towards $100.

Overall Performance

The Overall Average Return on Investment After Selling Fees for All Sets: 20.4% (up from 18.1%)

Despite little growth in March, 20.4% return on investment after 90 days is an incredible rate of return.

Had you blindly invested $100,000 on December 31st, 2022 you’d now have $120,400 in asset value AFTER all associate fees with liquidation.

You can’t get that kind of return anywhere else. (Well you can, but it’s likely illegal)

When market participants exhaust their supply while taking profit, I expect prices on those sets to spike heavily heading into the second half of the year.

My monthly personal LEGO portfolio update will come next week. You can read the February update here if you haven’t already.

When you are ready, there are two different ways I can help you:

If you are interested in starting an efficient one-person online business, I recommend starting with one of the following:

Textbook Flipping Mastery - My in-depth guide on how to start a high-margin Amazon e-commerce business.

LEGO Investing Mastery - My in-depth guide on how to start a long-term “buy, hold, and sell” LEGO investing business.

The Conference Room - My private mentorship community that includes the two guides above, for free. Pay once and stay a member for life.

If you are interested following along with my personal LEGO investment portfolio and unlocking access to 4 additional posts each month:

Become a paid subscriber here (7-day free trial available)supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.