Analyzing the Investment Returns of Retired LEGO Sets from 2022 After 150 Days

LEGOs > The stock market

This post is brought to you by me. If you want to learn how to get started with LEGO investing, look no further than my LEGO Investing Mastery guide.

In just 90 minutes, it will teach you how to outperform the stock market by buying, holding, and selling sealed boxes of LEGOs.

Get access to it here.

It feels like Christmas was just a month or two ago, yet we are now five months removed from the holiday season.

Every LEGO set that retired in December has now sat on the market for roughly 150 days.

Some sets have already provided a great return on investment, while others are complete duds.

Let’s take a look at how things have progressed over the last month.

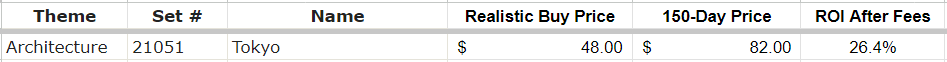

Architecture

Average ROI After Selling Fees: 26.4% (down from 31.0%)

Little bit of profit taking here but looking healthy overall.

City

Average ROI After Selling Fees: 11.0% (down from 13.8%)

If you removed the “Stunt” sets from this list, the return on investment would be about 18%.

No one likes the stunt sets (for good reason).

Pretty average results if you consider that, which is expected for such a broad theme.

Creator

Average ROI After Selling Fees: 22.6% (up from 21.9%)

Slight gain on the month for the Creator theme. The only set not in profit is the Lion set.

Having all sets in profit except for one after only five months is great to see and surprising considering the lower price point for most of these sets.

This is encouraging.

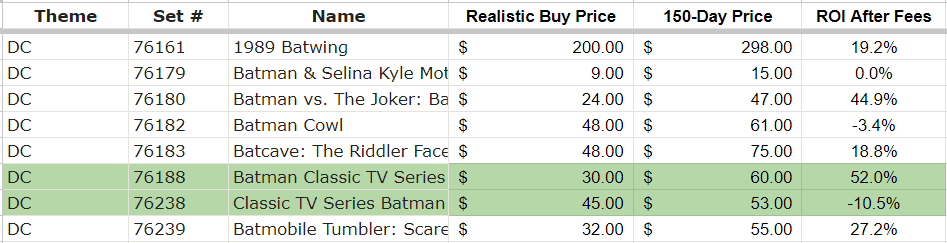

DC

Average ROI After Selling Fees: 18.5% (down from 20.5%)

Several sets are struggling here, which is a stark contrast to 2021 DC sets. I’m curious how things look in early 2024.

Disney

Average ROI After Selling Fees: 32.6% (up from 29.1%)

Like Creator, every set here is profitable except for one. This is encouraging to see so early post-retirement.

DUPLO

Average ROI After Selling Fees: 23.4% (up from 22.1%)

If the Jurassic Park & Spider Man sets weren’t in stock with Amazon still, we would be looking at much better numbers for DUPLO.

That being said, LEGO ruined this theme as a sneaky investment pick in 2022. They made way too many of these sets.

Friends

Average ROI After Selling Fees: 17.5% (down from 18.4%)

Not shocking to see these numbers from a broad set like Friends.

Harry Potter

Average ROI After Selling Fees: 34.1% (up from 33.8%)

You gotta love seeing every set in profit here. This is no surprise from Harry Potter.

Can’t wait to see how these do in December.

Holiday

Average ROI After Selling Fees: 26.7% (down from 27.1%)

The Holiday theme is always a fantastic hold if you are willing to be patient. Long term they do super well.

Icons

Average ROI After Selling Fees: 17.6% (down from 19.5%)

The first two sets are holding this theme back. They are either not very cool or seasonal. The bottom two are killing it.

Ideas

Average ROI After Selling Fees: 27.8% (up from 27.5%)

If Central Perk wasn’t in stock with Amazon, this would be one of the best performing themes right now.

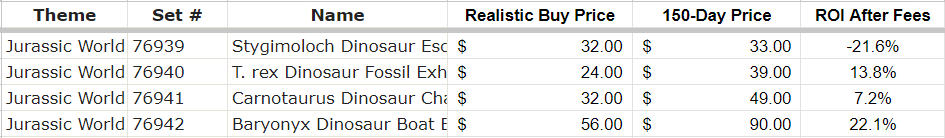

Jurassic World

Average ROI After Selling Fees: 5.0% (up from -3.3%)

A nice bump! What a welcome sight.

Still a long way to go to put out the dumpster fire that is the Jurassic World theme right now.

Mario

Average ROI After Selling Fees: 16.8% (up from 13.9%)

Only one set not in profit here but average results overall.

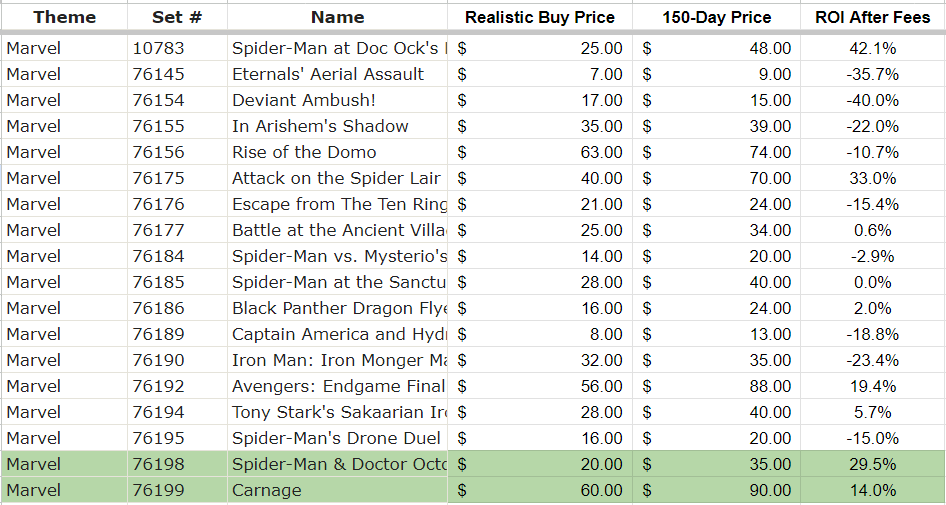

Marvel

Average ROI After Selling Fees: -2.1% (down from 1.5%)

Marvel is just like Jurassic World right now: downright terrible.

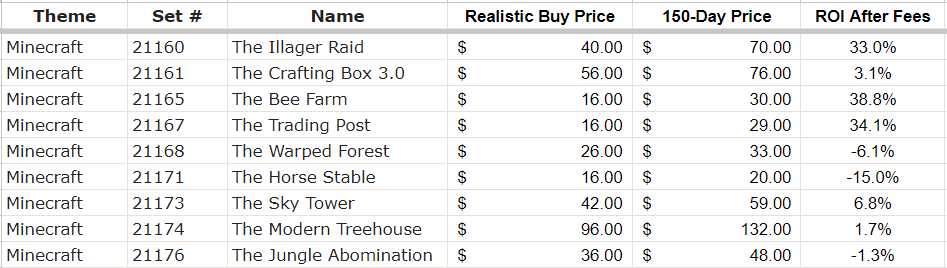

Minecraft

Average ROI After Selling Fees: 8.4% (down from 13.1%)

Trending in the wrong direction here. Sad to see.

Minions

Average ROI After Selling Fees: 39.7% (unchanged)

I’m laughing all the way to the bank.

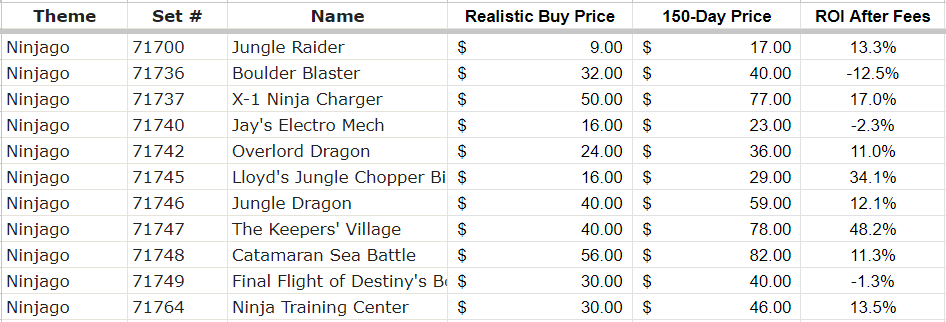

NINJAGO

Average ROI After Selling Fees: 13.1% (down from 13.7%)

Below average results for a below average theme.

Speed Champions

Average ROI After Selling Fees: 19.4% (unchanged)

I’m wondering if the average return for this theme hits 60%+ come December… it seems doable now.

Star Wars

Average ROI After Selling Fees: 44.4% (up from 42.1%)

What you know… it’s the best performing theme! No one should be surprised.

Every set is in profit.

I don’t see this changing for future retiring Star Wars sets.

Technic

Average ROI After Selling Fees: 43.8% (down from 43.9%)

If Star Wars is 1A, Technic is 1B, with Harry Potter following those two. You can’t go wrong with this theme.

Overall Performance

The Overall Average Return on Investment After Selling Fees for All Sets: 20.1% (down from 20.6%)

For the first time in 2023, we have a dip in value for all sets that retired in 2022.

This is not surprising as Timmy sellers get impatient and start taking profit early. It only reduces supply for those who wait until the holiday season to sell.

Let’s compare it to a few other assets:

S&P 500 YTD: +8.43%

Gold YTD: +6.45%

My Personal LEGO Portfolio: +33.5%

Had you blindly bought LEGOs at the end of 2022, you’d be doing better than most people.

Had you used my portfolio as inspiration, you’d be doing exceptionally well.

I expect LEGO values to tread water or slightly increase before increasing heavily about six months from now.

When you are ready, there are two different ways I can help you:

If you are interested in starting an efficient one-person online business, I recommend starting with one of the following:

Textbook Flipping Mastery - My in-depth guide on how to start a high-margin Amazon e-commerce business.

LEGO Investing Mastery - My in-depth guide on how to start a long-term “buy, hold, and sell” LEGO investing business.

The Conference Room - My private mentorship community that includes the two guides above, for free. Pay once and stay a member for life.

If you are interested following along with my personal LEGO investment portfolio and getting exclusive alerts when I add a new set to that portfolio:

Become a paid subscriber here (7-day free trial available)

These posts are not financial or investment advice.

They are made for entertainment purposes only by a bum who gave up his job as a prestigious Aerospace Engineer to talk about investing capital in things like LEGOs.