Analyzing the Investment Returns of Retired LEGO Sets from 2022 After 180 Days

The ascent continues.

This post is brought to you by me. If you want to learn how to get started with LEGO investing, look no further than my LEGO Investing Mastery guide.

In just 90 minutes, you will learn how to start LEGO investing process in the most efficient way possible AND which costly mistakes to avoid as a beginner.

Get access to it here.

Nearly six months ago, several LEGO sets retired at the end of 2022 in traditional fashion.

Some sets have exploded in value, others have climbed modestly, while others remain stagnant.

Here at The Introvert Entrepreneur, I track prices on a monthly basis out of curiosity and in an attempt to understand what makes a good investment, a good investment.

On that note, you may remember my mention of a new set picking “system” in the post preceding this one. (read it if you haven’t)

While I showed how good the numbers looked after multiple back-tests, I did not share the specific criteria the system uses.

Instead, I shared that with owners of my LEGO Investing Mastery guide this week, in a free 40 minute update. (Check that out if you have not already)

With that out of the way, let’s take a look at the market and how it has transformed since this time last month.

Architecture

Average ROI After Selling Fees: 23.3% (down from 26.4%)

The profit taking continues. Not shocking to see during the slow and quiet months of summer.

City

Average ROI After Selling Fees: 9.1% (down from 11.0%)

Slight decrease in returns as Amazon sellers continue to take profit.

City as a whole remains below average performance.

Creator

Average ROI After Selling Fees: 21.0% (down from 22.6%)

Creator has been treading water here for a few months in average territory. The Lion set is still the only set that hasn’t become profitable yet.

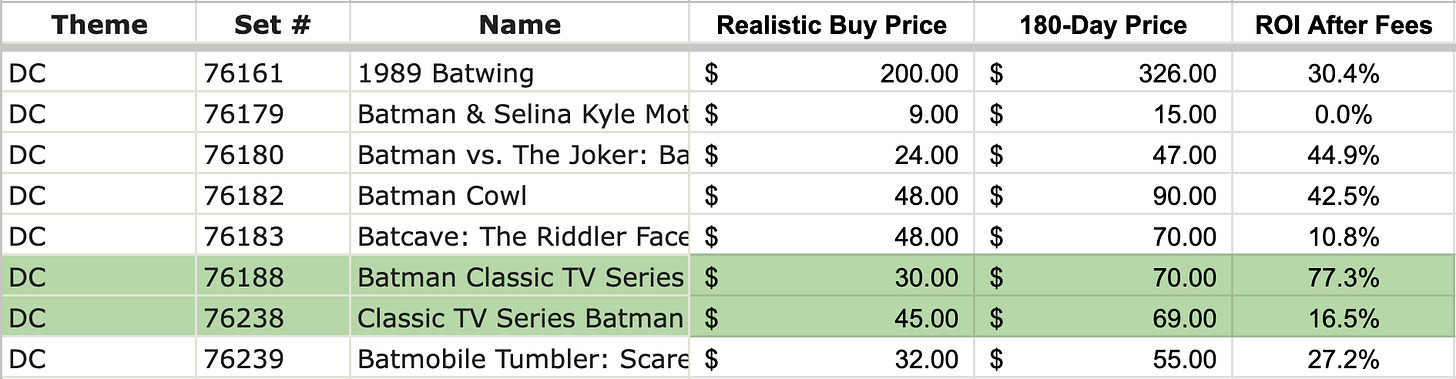

DC

Average ROI After Selling Fees: 31.2% (up from 18.5%)

A HUGE swing here thanks to the Batman Cowl jumping from $60 to $90 and almost every other set trickling upwards by a few dollars.

I don’t know what happened, but this is a huge shift in behavior for almost this entire theme.

Every set is now profitable. Wonderful to see. DC has swung from below average to above average in a few weeks time.

Disney

Average ROI After Selling Fees: 31.8% (down from 32.6%)

Treading water here and still above average performance.

DUPLO

Average ROI After Selling Fees: 29.7% (up from 23.4%)

Nice move upwards here to above average performance.

If the Jurassic Park and Spider Man sets weren’t so oversupplied, DUPLO would be one of the better performing themes (like it used to be).

When Amazon runs out, this theme will make up for a ton of lost ground.

Friends

Average ROI After Selling Fees: 16.4% (down from 17.5%)

Ever so slight decline here. Not much going on. Friends, like the City theme, is a below average performer.

Harry Potter

Average ROI After Selling Fees: 28.8% (up from 34.1%)

A few key sets are seeing some heavy profit taking as Timmy investors get impatient.

All Harry Potter sets remain profitable and the theme is performing slightly above average.

Holiday

Average ROI After Selling Fees: 18.3% (down from 26.7%)

Somebody got sick of holding their inventory and is dumping a few of these sets at the moment.

They are now performing below average.

Icons

Average ROI After Selling Fees: 20.9% (up from 17.6%)

The first two sets are holding the Icons theme inside below average territory.

Ideas

Average ROI After Selling Fees: 23.5% (down from 27.8%)

The Central Perk set has the Ideas theme performing right on average. When Amazon runs out, it will improve immediately.

Jurassic World

Average ROI After Selling Fees: 7.3% (up from 5.0%)

Jurassic World trending in the right direction but has so much ground to make up.

It’s going to be a long road.

Mario

Average ROI After Selling Fees: 19.3% (up from 16.8%)

Super Mario trying hard to break out of below average territory. We will see if it continues, but I don’t see it happening.

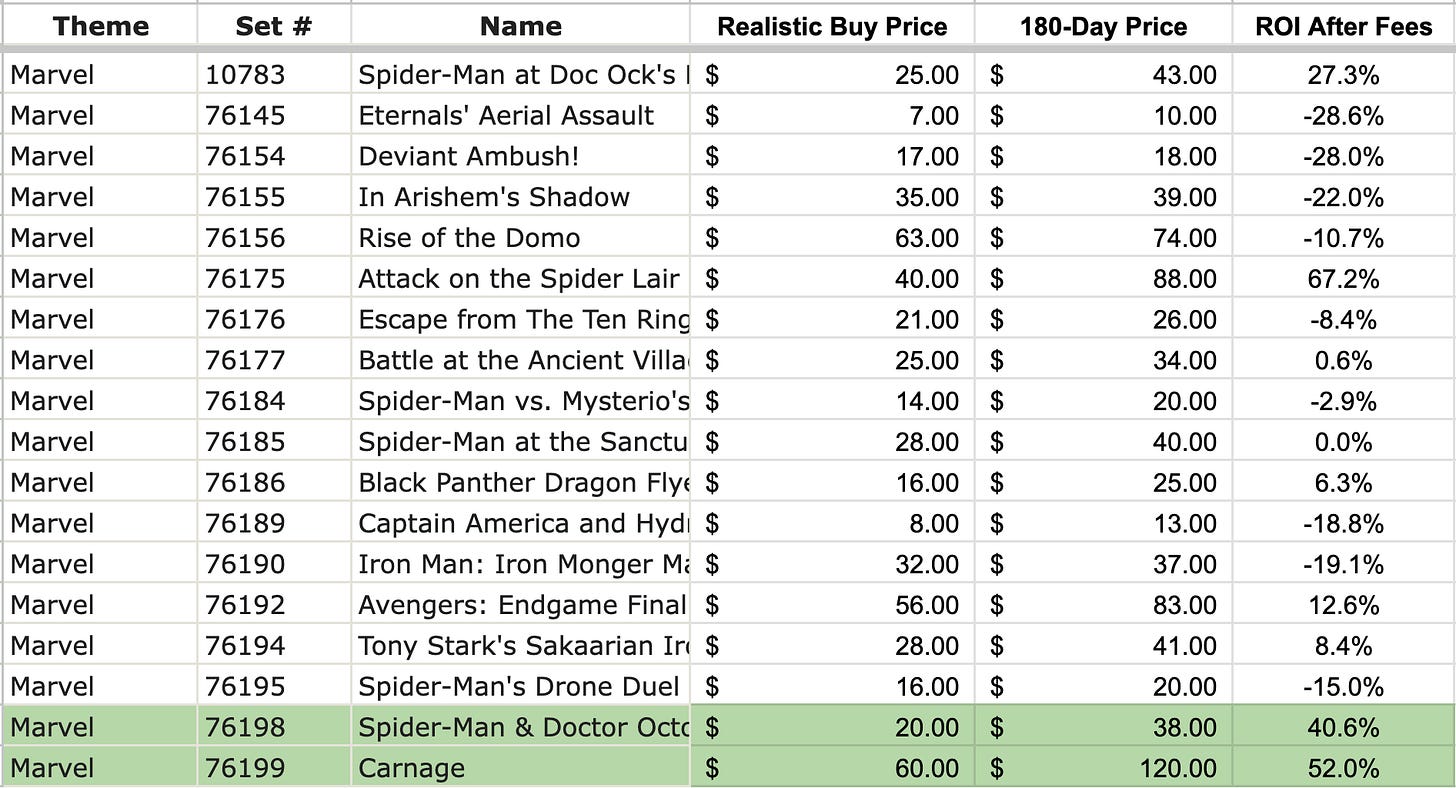

Marvel

Average ROI After Selling Fees: 3.4% (up from -2.1%)

If you remove every Avengers set from this list, the results look a lot nicer. Unfortunately, Marvel will remain held back by all of those terrible sets.

Minecraft

Average ROI After Selling Fees: 8.7% (up from 8.4%)

Minecraft remains ugly. No one should be surprised.

Minions

Average ROI After Selling Fees: 27.7% (down from 39.7%)

Even the best themes are not immune to profit taking from investors. Given that sales volume is below average with Minions, the price swing is normal.

It will recover when the selling pressure decreases.

NINJAGO

Average ROI After Selling Fees: 22.5% (up from 13.1%)

I was not expecting such a large jump from DC themed sets and the same applies to NINJAGO.

Several sets bump up a few dollars within the last month.

This is nice to see from a theme that has been so disappointing.

Speed Champions

Average ROI After Selling Fees: 18.2% (down from 19.4%)

Slight decrease from Speed Champions. I don’t see it breaking out from below average performance before November/December.

Star Wars

Average ROI After Selling Fees: 46.2% (up from 44.4%)

Just when you think Star Wars is going to take a breather, it continues to improve.

It’s incredible to watch. It’s so far above average it’s not even funny.

Technic

Average ROI After Selling Fees: 40.8% (down from 43.8%)

Little bit of profit taking, but still fantastic performance overall.

Overall Performance

The Overall Average Return on Investment After Selling Fees for All Sets: 23.3% (up from 20.1%)

Last month was the first month in 2023 that the overall returns for 2022 retiring sets dipped in value.

This month, sets continued to appreciate. Despite all of the profit taking, things are heading in the right direction.

Let’s compare those results to a few other assets:

S&P 500 YTD: +14.1%

Gold YTD: +4.9%

My Personal LEGO Portfolio: +35.6%

Regardless of how you did it, investing in LEGOs blindly or following along with my portfolio would have you ahead of most other investment assets.

This has been the case for the entire year and is what has happened for decades on end.

That’s it for June, let’s see what the second half of 2023 has in store for us.

When you are ready, there are two different ways I can help you:

If you are interested in starting an efficient one-person online business, I recommend starting with one of the following:

Textbook Flipping Mastery - My in-depth guide on how to start a high-margin Amazon e-commerce business.

LEGO Investing Mastery - My in-depth guide on how to start a long-term “buy, hold, and sell” LEGO investing business.

The Conference Room - My private mentorship community that includes the two guides above, for free. Pay once and stay a member for life.

If you are interested following along with my personal LEGO investment portfolio and getting exclusive alerts when I add a new set to that portfolio:

Become a paid subscriber here (7-day free trial available)

These posts are not financial or investment advice.

They are made for entertainment purposes only by a bum who gave up his job as a prestigious Aerospace Engineer to talk about investing capital in things like LEGOs.