LEGO Sets Can Make You Rich and I Can Prove It

The stock market doesn't provide returns like this... just saying.

After introducing a new monthly investment report to The Introvert Entrepreneur earlier this month, it’s time to start backing everything up with some research.

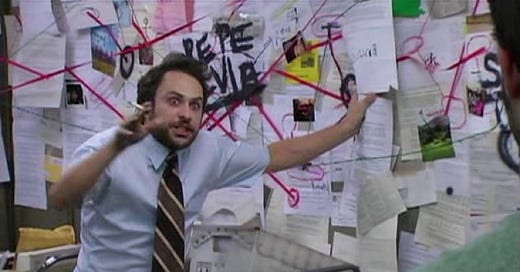

I probably sound like this guy after you read that latest LEGO post:

I’ll do my best to put money where my mouth is in this post and several more in the future.

Today’s post will focus on the following:

The performance of sets that retired EOY 2021 (11 months ago)

Which set characteristics signify better than average future performance

Everything mentioned below should be absorbed with the following overarching theme in mind:

LEGO is best invested in over a 0-24 month period post-retirement, if maximum return on investment is the goal.

You can buy and hold these things for a lifetime, but your returns will look similar to your 401k following those first couple post-retirement years.

As was mentioned in another recent post, this phenomenon is called the “retirement pop” and has stood the test of time.

The data below comes from a list of over 100 sets that retired at the end of 2021 with prices quoted via Amazon.

In all honesty, I am doing a disservice by posting this prior to the upcoming holiday spending spree that will push values even higher. (We will revisit this data in a few months time for that reason)