The Best Investment on Earth: LEGO

An introduction to a market that many don't even know exists.

The post is brought to you by me.

If you’re going to invest in LEGO, you need to keep track of your investments.

Look no further than my LEGO Investing Portfolio Tracker.

This is a spreadsheet created by Anthony (a newsletter subscriber & mongo927 on Discord) that helps you become a more organized and responsible investor.

It automatically calculates everything you need to know about how well your investments are performing.

For a small one-time fee, you get lifetime access to all future updates so you can stay organized and confident about your investments.

It’s time to introduce one of the greatest investment opportunities on planet earth.

Before we do, let’s revisit:

What the point of investing is

What type of investments you can make

What is considered “normal” when it comes to investment performance

Investing is the simple act of attempting to appreciate or preserve your capital.

There are two types of investing:

Active (It takes effort alongside the investment i.e. starting a business)

Passive (No work required i.e. stocks/bonds/Pokémon cards)

Long time readers will know that I only recommend “passive” investing only once you have exhausted all resources on active investments.

For me, this was when I was working 12 hours every day, 7 days per week AND had money sitting there that I didn’t have the time to use.

The reason? Active investments perform better on average.

The book business mentioned in this post below is a perfect example of an active investment:

The reality is: No passive investment can provide a 100-200%+ return on capital in just a couple of months like an e-commerce business can.

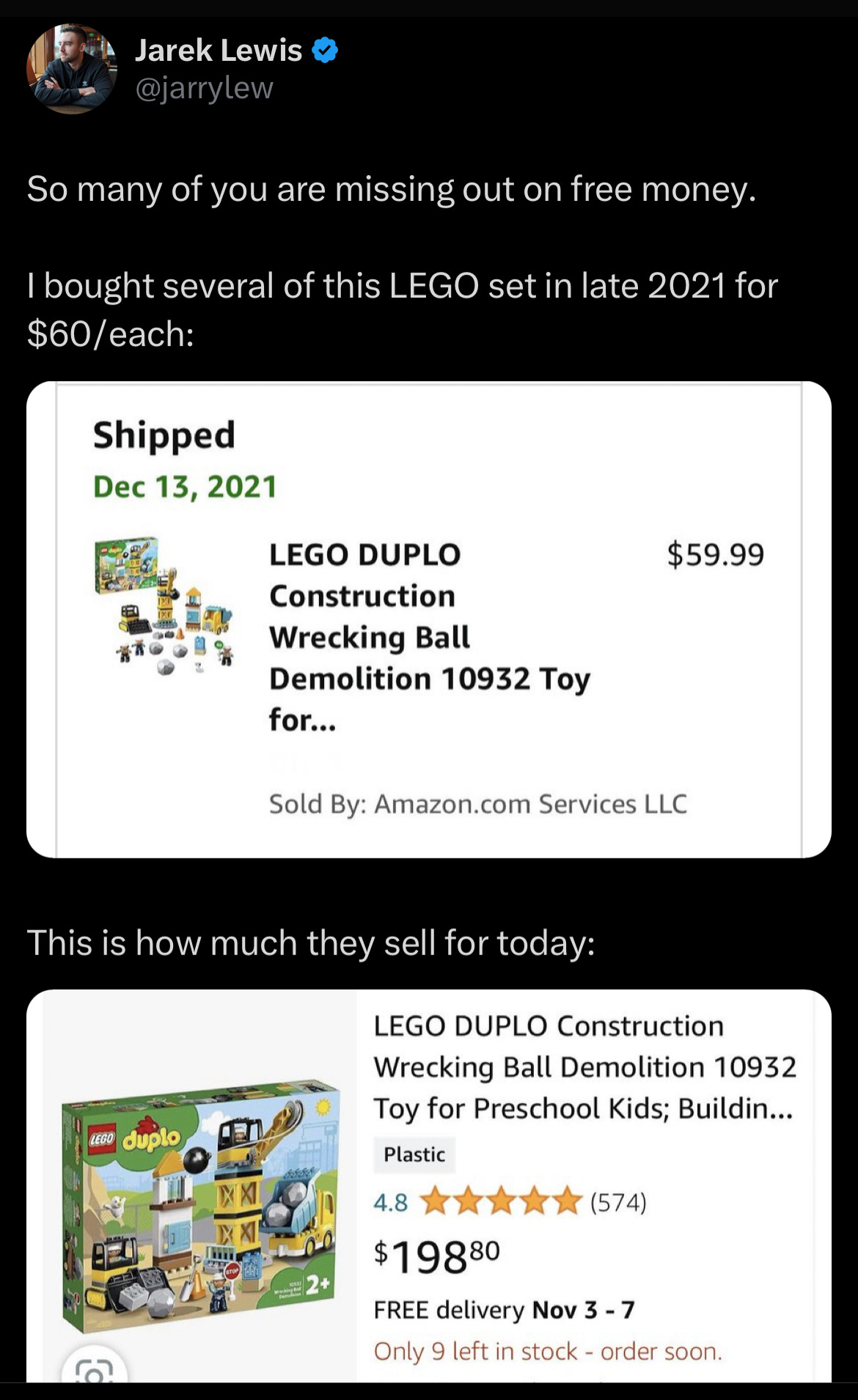

Historically, passive investment returns of 5-10% annually are considered great. Anything above that is considered incredible.

Investing in LEGO (the right way) allows you to capitalize on the best of both active and passive investing.

Allow me to explain.

LEGO has the same unique characteristic that sealed trading cards have.

Once a LEGO set is no longer manufactured (we call this “retirement”), supply becomes capped.

As they are unsealed, the supply decreases over time. If demand stays the same, this results in an increase in value for the LEGO set.

The aforementioned demand assumption is a safe one. People love LEGO. Kids love them and adults collect them.

It’s been this way for decades.

That’s not the whole story though.

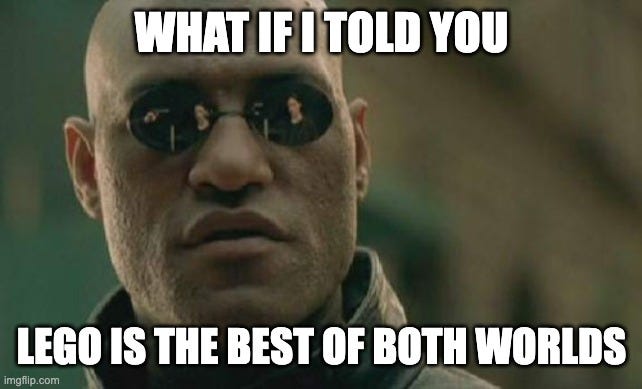

When LEGO sets retire, a funny thing happens. ~95% of the time, all retailers run out of stock right around the retirement date.

It is then up to third parties (like you and I) to supply the market with inventory, which often results in what I call the “retirement pop”.

The price of many LEGO sets pop in value by 20-30% the moment they retire.

From there, it is a rapid climb in value for 6-18 months before slowing down and acting like a traditional asset.

By capitalizing on this retirement pop and holding for roughly 12 months it is possible to achieve returns like no other market can.

It is not uncommon to see a LEGO set return upwards of 100% ROI in a single year.

Here is the three step process to my personal LEGO investing strategy:

Buy LEGO sets at discounted prices in the second half of the year (20% OFF is easy to find)

Hold for 12-18 months and then sell on Amazon

You can turn $10,000 into $20,000-40,000 in a single year doing this, so long as you pick the right LEGO sets.

I’m not the first person to realize this, nor are these kind of returns “guaranteed”.

However, this is just what has happened every year since the ability to track historical Amazon data became possible.

In fact, I document the results of my personal LEGO investment portfolio every month inside this newsletter.

Is it possible that we enter a recession and consumer spending slows down so much that this isn’t as profitable?

Yes.

However, that didn’t even happen during the 2008-2009 recession:

LEGO rose as real estate plummeted and this graph doesn’t even account for the retirement pop.

Nothing in life is guaranteed, including LEGO investment returns.

That said, the greatest risk of all is never taking any risk.

It just so happens that LEGO has the best risk/reward profile I’ve ever seen.

You can take advantage of that or ignore it. The choice is yours.

When you are ready, there is one way I can help you:

Join 600+ people in becoming a paid subscriber to this newsletter

In doing so, you get access to:

My private mentorship group on Discord (this used to be $329)

Buy/Sell alerts for LEGO (these will make you money)

Buy/Sell alerts for Pokemon card investments (these will make you money)

These resources will show you how make your first $1,000 on the internet using the same methods I used to escape the rat race.

Get access to it for free by becoming a paid newsletter subscriber:

This post is not financial or investment advice.

I am simply informing you of what I have done with my own capital.

What you choose to do with your capital is at your own discretion.

While I will always vouch for the content I publish and the ideas I teach, there are limits to what I’m legally allowed to encourage without putting myself in harms way.

Same ^ Also i'm already a paid subscriber- Is there anyway you can only post this stuff to your non paid audience?

I'm a newly paid subscriber. How do I find the discord mentorship group?