The Ultimate LEGO Investing Logistics Guide

Everything you need to know about this process, in a nutshell.

In my recent post titled, “The Best Investment on Earth: LEGO” I discuss the theory and facts behind that bold statement.

What I have not yet explained, is how the logistics process works from start to finish.

This isn’t like regular investing.

Investing in an index fund is easy as hell. You just tap a couple of buttons on your brokerage app and you’re done.

However, you can’t do that with LEGO. They are physical products that require movement and storage.

Here is what you must understand, if you want to begin this journey.

Step 1: Research

Similarly to investing in any other asset, the research comes first.

While LEGO as a whole are great investments over time, maximizing your returns will come from identifying sets with the best risk/reward profile.

Diversification is important, but targeting the right sets can result in returns that the stock market only dreams about.

You want to analyze several of the following factors:

Retirement date

Demand

Which retailers sell the set

Shelf life

While other factors matter, these matter most and are what I used to decide which sets I invest in.

Step 2: Buying

When buying into an index fund, you can buy as much as you want with the click of a button.

It doesn’t work that way with LEGO.

Many stores don’t like you buying more than 1-10 of any one set and go out of their way to prevent you from buying more than that.

There are workarounds like creating additional website accounts and shipping to multiple addresses that are required.

You have to get crafty if you want to purchase most sets in heavy quantity.

We talk about stuff like this in my private mentorship group.

Step 3: Receiving & Storing

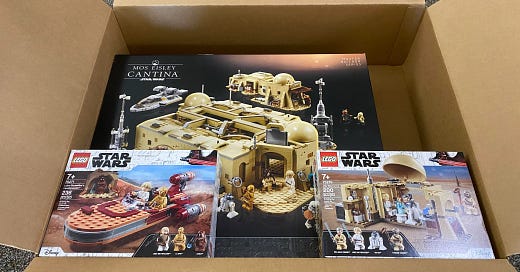

Remember now, LEGO comes in giant cardboard boxes.

This means you need storage space that is temperature & humidity controlled.

With the general premise being a hold time of 12-18 months, you need something better than your living room.

Some sellers use different parts of their home/garage, but I use a third party to receive and store my items for me.

More specifically, I pay a prep center to receive my orders of LEGO and then store them.

Once I want to sell them, they ship to Amazon for me.

While I pay for that service, it’s worth the peace of mind that comes with not storing well over six figures worth of product in my home.

I sleep better knowing I’m less of a target.

Step 4: Prepping & Selling

After prices reach your desired selling point, it’s time to collect that profit.

There are a number of different marketplaces you can sell on, but none provide the return that Amazon does.

Getting an Amazon Seller account created and getting ungated with the LEGO brand is a must.

You can either send the LEGO to Amazon in bulk and have them ship them to your customers or you can do the shipping yourself.

I prefer sending mine to Amazon because customers prefer fast Prime shipping that comes with listing that way.

Either one works.

As you can tell, this is an involved process that requires a lot more of a time investment than buying some shares of your favorite stock.

However, this is what allows you to see returns of 100%+ in a 12 month period.

There is a ceiling to how much you can make with LEGO.

This is type of investing is not for someone with $1 billion, one person just can’t buy that many LEGOs.

This is instead for someone who wants to turn $10,000 into $100,000 or $100,000 into $1,000,000 in less than 5 years.

Have a question? Leave it in a comment down below.

This posts are not financial or investment advice.

It is written for entertainment purposes only by a bum who gave up his job as a prestigious Aerospace Engineer to talk about parking money in things like sealed boxes of plastic.

How does one go about getting ungated approval for Lego on Amazon?

Question on the prepping and selling part. All of the sets I purchased in 2023 to sell 2024 I was approved to sell on Amazon even up to a couple months ago but now are restricted. Can you talk about the seasonal Amazon restrictions for Lego and when those might be lifted? Looking into Walmart and eBay now.