Apparently you hate money. If you didn’t, you’d be using Rakuten every time you shop on websites like Walmart and Target to save money.

They have paid me over $13,943 for things I was already going to buy for my one-person business:

They are also the reason this post is free to read. Sign up here and get $30 for free after your first use.

Rakuten isn’t just a newsletter sponsor, they are an important part of my one-person business that I’ve used for years.

Today, I am going to explain what they do (so we are all on the same page) and then explain how I am doubling down on what they offer in 2024.

Stick with me on this one, I need you to read this entire post because it gets good.

Rakuten’s business model is simple:

They offer us free cash back to use their website/extension when shopping online

After we shop, the websites in question pay them a referral fee

Rakuten gives us part of the referral fee

Websites pay them and they pay us a cut.

Prior to 2024, I used it like any other person while operating my businesses and accumulated nearly $14,000.

However, at the beginning of this year I decided to take things to the next level…

The first thing I did was apply for an American Express Business Platinum Schwab card:

The Charles Schwab variant of this card has a specific perk that allows you to transfer your American Express reward points to a Schwab brokerage account.

(You also get free lounge access at the airport with it, among other things, click here to sign up for one if what it offers sounds nice to you)

When those points arrive into the brokerage account, they become cash.

Not only that but Amex give you a 10% bonus, which turns every $1 in points into $1.10.

You’re probably thinking, “that’s cool, but what does it have to do with Rakuten?”

Well, you can request that Rakuten pays you in American Express Reward Points:

That means by having the Platinum Schwab Card, you get a 10% bonus on ALL cash back earned with Rakuten.

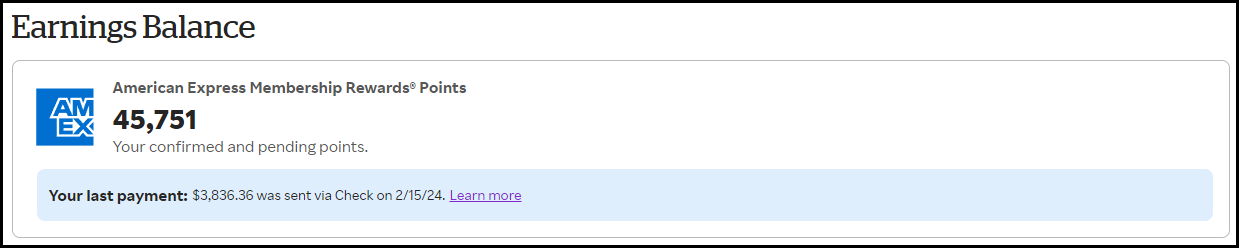

So far in 2024, I have earned 45,751 Amex Points (~$503) with Rakuten:

That’s not an impressive total, but given that during Q1-Q3 I don’t do a lot of inventory purchases, it is a normal total for me.

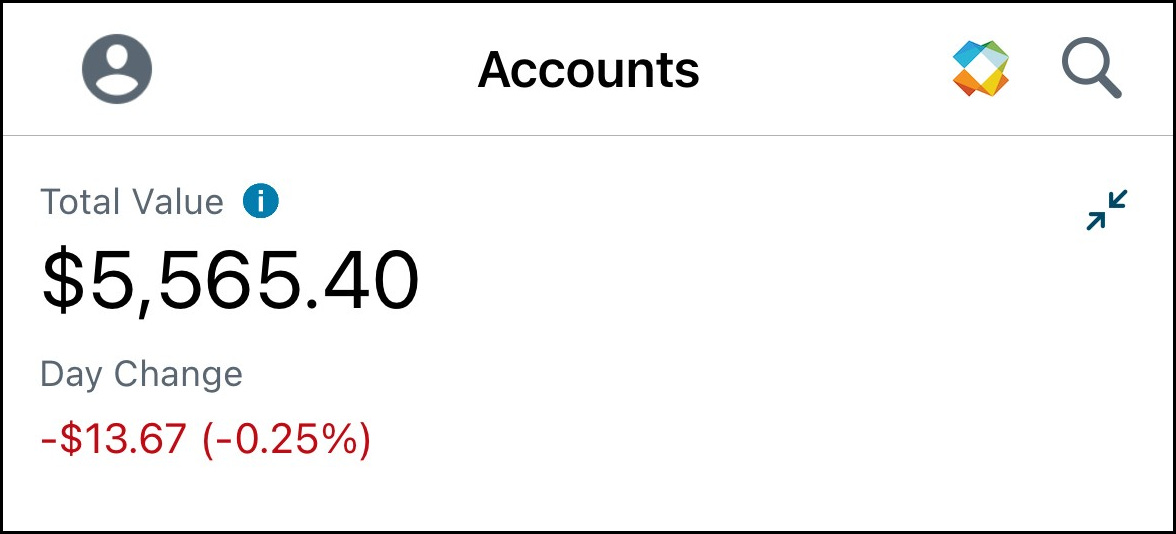

I already had roughly $4,500 in Amex points accrued from regular credit card cash back sitting around doing nothing, so I transferred those to Schwab at the beginning of the year.

The balance of the Schwab account is currently $5,565.40:

I tell you all of this to announce that on a monthly basis, I am going to regularly document:

My Rakuten earnings

My Charles Schwab brokerage account balance

While on this journey, I have two goals:

Increase my Rakuten earnings (but only if efficient)

Hit 6 figures inside the Schwab account

Theoretically speaking, if I could find an efficient way to spend $100,000/month on product that didn’t even make me money (but also didn’t lose me money), I would do it.

5% in total cash back (Rakuten + Credit Card) on $100,000/month would mean a free $5,500/month once the points hit the Schwab account.

Easier said than done (like all things worth doing) but worth exploring…

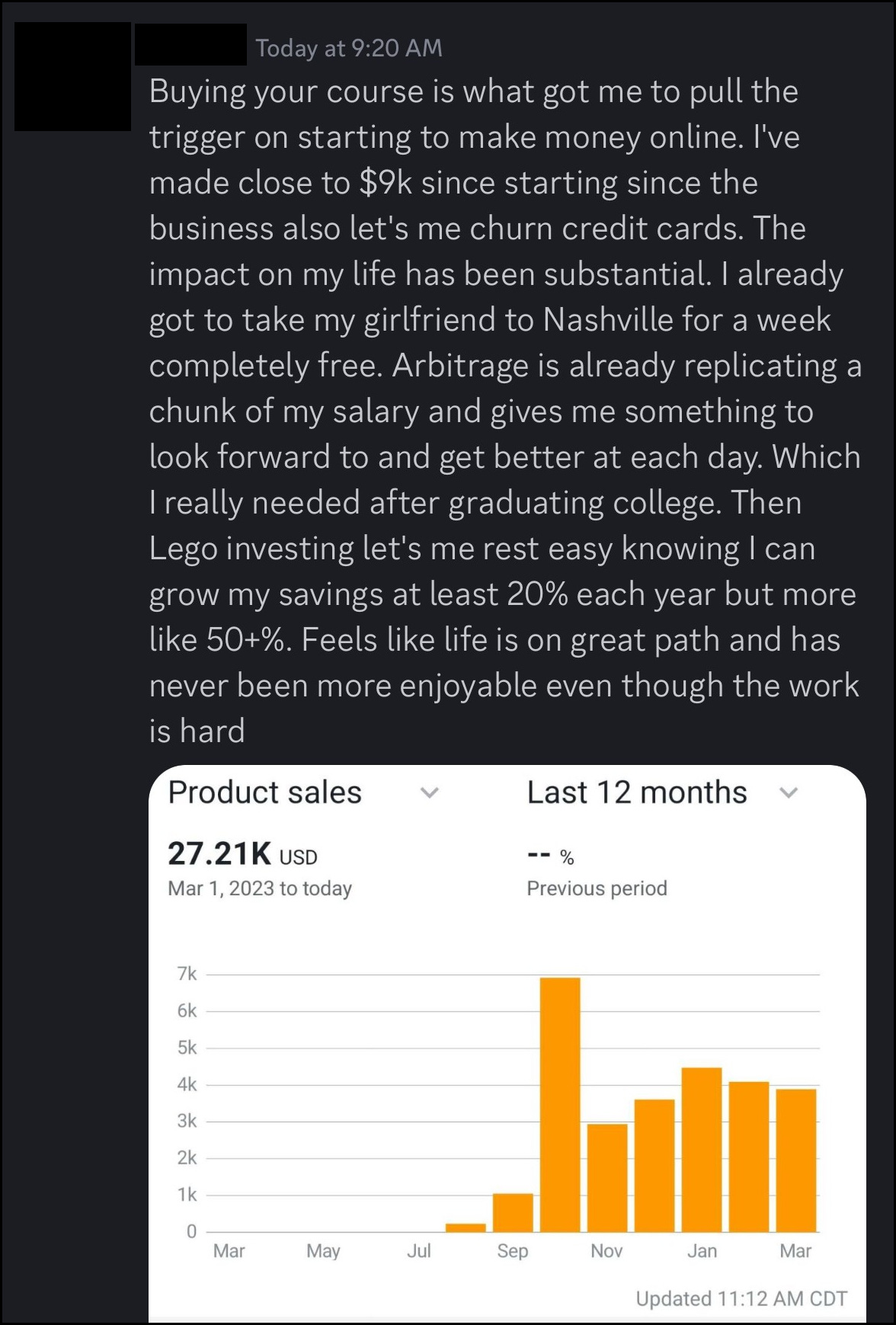

Before I go, I want to leave you with this:

This is what is possible when you take what I teach and apply concentrated effort behind it for a significant chunk of time.

You can change your life and provide things for the people you love that you weren’t able to prior.

The only requirement is that you take action. That choice is yours and I can’t make it for you.

If you want to get the most out of Rakuten, you should have an Amazon business and/or a LEGO investing business.

Here are 3 different ways I can help you accomplish that:

Textbook Flipping Mastery - My in-depth guide on how to start a high-margin but simple Amazon e-commerce business

LEGO Investing Mastery - My in-depth guide on how to start a long-term “buy, hold, and sell” LEGO investing business

The Conference Room - This is my private mentorship community that includes the two guides above for free