TIE #054: The Road to $100,000 with Rakuten + American Express - April 2024

Watch me show you how to create 6 figures out of thin air.

Apparently you hate money. If you didn’t, you’d be using Rakuten every time you shop on websites like Walmart and Target to save money.

They have paid me over $13,943 for things I was already going to buy for my one-person business:

They are also the reason this post is free to read. Sign up here and get $30 for free after your first use.

Rakuten isn’t just a newsletter sponsor, they are an important part of my one-person business that I’ve used for years.

Today is the first update for a series started last month that documents my Rakuten earnings and the brokerage account it is connected to.

The goal of this series is to hit $100,000 in the brokerage account, by any means possible.

I know that sounds insane but I don’t care.

You may not know this but Rakuten allows you to receive payments in American Express reward points instead of cash.

(Something I learned way too late)

This is important because if you have an American Express Platinum Schwab card (click here to sign up for it) the rewards points you get from Rakuten get a 10% bonus when deposited into a Schwab brokerage account.

Let’s take a look at our Rakuten earnings:

Total Unpaid Points: 65,464 (up from 45,751 last month)

Cash Value: $720.10

$720 in three months doesn’t look impressive at all and don’t worry, it isn’t.

However, this number will take a significant jump in the second half of the year.

Spending for my Amazon/LEGO business takes a huge leap in the early summer and in Q4.

There is also opportunity for credit card sign-up bonuses along the way.

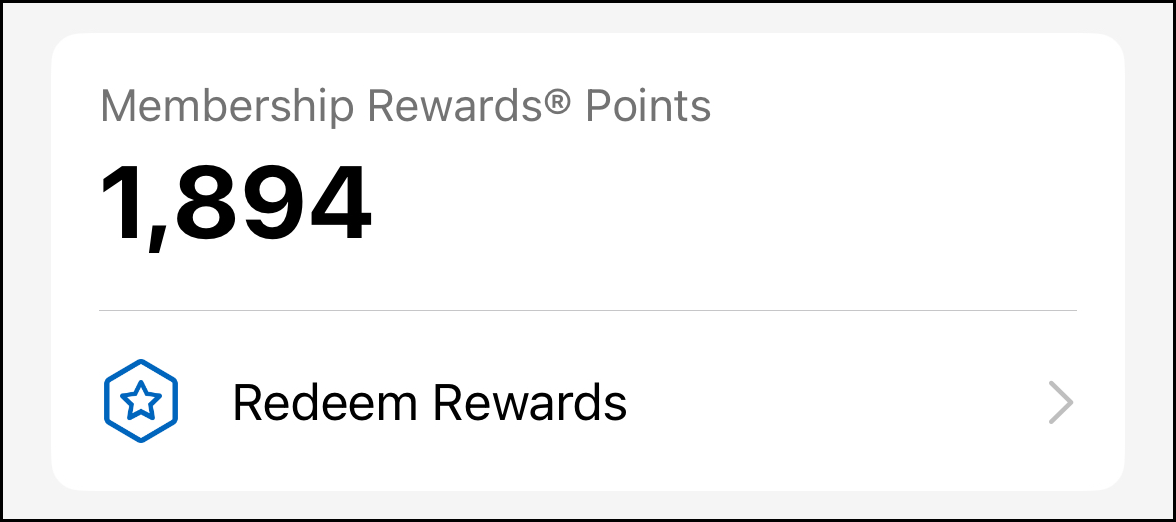

Speaking of credit cards, here is my American Express rewards balance:

Total Rewards Points: 1,894

Cash Value: $20.83

Not much there.

We haven’t been using any American Express cards within the business, outside of the Platinum Schwab card in an attempt to earn the sign up bonus of 80,000 points.

I should have that taken care of by the end of April.

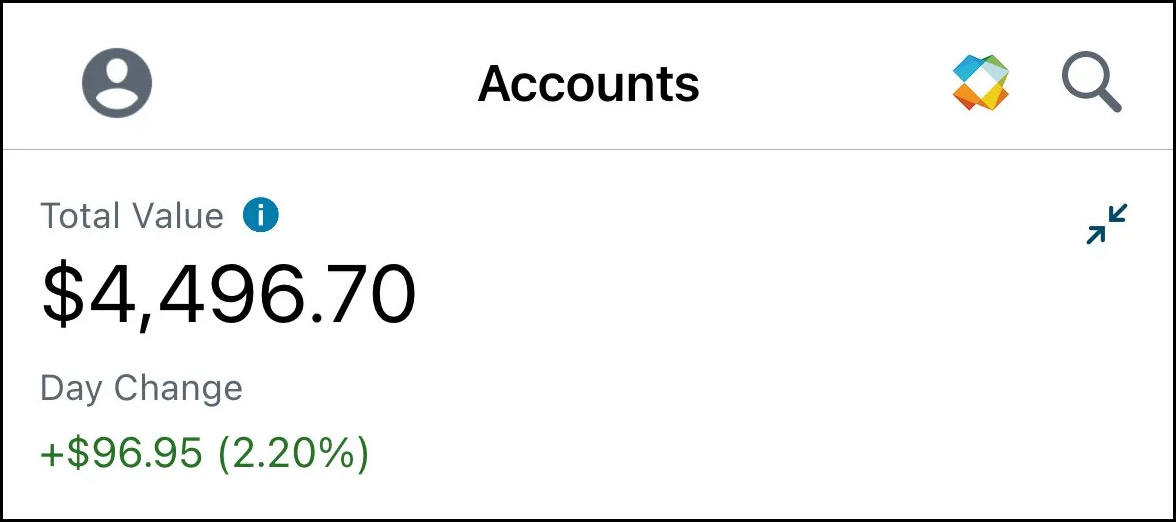

I’m afraid to say our brokerage account took a hit over the last month:

Total Value: $4,496.70 (-$1,068.70)

I thought I was slick and created a couple degenerate positions in the hopes of bumping the account value up, but that didn’t happen.

Moving forward, it is my intention on limiting this account to only hold a money market position or broad index funds.

The last thing we want is to experience significant drawdowns like we did over the last month.

Total Cash Value (all of the above): $5,237.63

Reaching our goal of $100,000 will take some serious spending and not just during specific times of the year.

Knowing this, I am silently working on leveraging several churning resources like cash-out/buying groups and manufactured spending.

It is time to kick our spending into high gear, so we can march towards $10,000 and then $100,000 in the brokerage account.

I want to prove just how powerful Rakuten and credit card points are in real time.

When you are ready, there is one way I can help you:

The Conference Room: Join 700+ members inside my private mentorship group. It teaches you exactly how to build an efficient, lean, and focused Amazon FBA business.

Come inside and receive help from myself, several expert business owners, and get access to both of my premium video guides.

Heard this on a Chris Potter YouTube : cash back (like from Rakuten) reduces the cost of your business inventory, which increases your taxable revenue

Enjoyed this post and look forward to following along with updates to this challenge. Are you going to share any of the resources or tactics related to buy groups or manufactured spend here (or in The Conference Room)?