Analyzing the Investment Returns of Retired LEGO Sets from 2021 After 16 Months

A look back at how much money you would have made if you invested in LEGOs at the end of 2021.

This post is brought to you by me. If you want to learn how to get started with LEGO investing, look no further than my LEGO Investing Mastery guide.

In just 90 minutes, it will teach you how to outperform the stock market while keeping you from making costly mistakes.

Get access to it here.

If you are brand new to the idea of LEGO investing, you might not know that I document several things inside this newsletter each month:

The performance of my personal LEGO investment portfolio (latest post here)

The performance of LEGOs that retired in 2021 (you’re reading this now)

The performance of LEGOs that retired in 2022 (latest post here)

By presenting you this data, I am also educating myself on which trends translate into the most amount of upside when investing in LEGOs.

The online business game is a game of efficiency and there are always areas that can be improved upon.

With that said, let’s take a look at how the sets from 2021 are performing after aging for 16 months on the open market.

Architecture

Average ROI After Selling Fees: 32.1%

All sets are in profit, but the returns here are bad for 16 months post-retirement.

City

Average ROI After Selling Fees: 51.7%

City has one major issue in that they make too many sets.

This spreads out the liquidity and keeps returns rather average unless you only invest in cheap sets and wait a long time before taking profit.

Cheap sets have a couple inherent hurdles as well. You usually can’t get a ton of them and if you can, they will take months on end to get rid of.

Creator

Average ROI After Selling Fees: 57.3%

Only one set hasn’t made money, while the rest look healthy.

DC

Average ROI After Selling Fees: 84.4%

You couldn’t have gone wrong on any of these sets back in 2021. 2022 isn’t a different story at the moment… but that could change.

Disney

Average ROI After Selling Fees: 29.3%

Investing in Disney either ends up fantastic or terrible. There is no in-between.

Friends

Average ROI After Selling Fees: 45.7%

The nice thing about Friends is you are likely to make profit no matter what you invest in.

The bad thing is the returns are always average or below-average.

They make far too many sets, in my opinion.

Harry Potter

Average ROI After Selling Fees: 61.7%

Every set is in profit, with a few underperforming. Harry Potter will always be a great place to park your capital though.

Ideas

Average ROI After Selling Fees: 57.9%

Consistently strong performance by all three sets here.

Jurassic World

Average ROI After Selling Fees: 34.3%

My distaste for Jurassic World is justified when you see these numbers. People just don’t care about dinosaurs as much as they used to.

Mario

Average ROI After Selling Fees: 48.0%

All sets are in profit, but I find that liquidity is low on most of them. If I invest in them in the future, I will keep quantity low.

Marvel

Average ROI After Selling Fees: 77.9%

Either Marvel ages well or something changed between sets that retired in 2021 vs. 2022.

I’m not sure which is true.

These sets are performing great while the 2022 retired sets are abysmal so far.

Time will tell.

Minecraft

Average ROI After Selling Fees: 56.3%

Every set in profit, that’s good to see. Seeing how well 21163 is performing makes me want to check the performance of all Minecraft Dungeons sets…

Minions

Average ROI After Selling Fees: 85.4%

Minions = $$$. It’s that simple.

NINJAGO

Average ROI After Selling Fees: 50.9%

NINJAGO ages like the Friends theme it appears. Good results but at or below average performance.

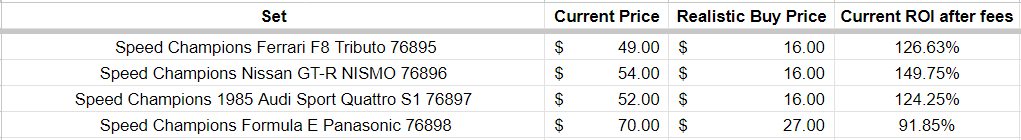

Speed Champions

Average ROI After Selling Fees: 123.1%

The more I look at Speed Champions, the more I am starting to feel I was wrong about their performance for 2022 retiring sets.

I think the important part is being extra patient with them, due to the low average price point.

Star Wars

Average ROI After Selling Fees: 95.3%

If you are new to this game and don’t know where to start, start with Star Wars.

The only set that hasn’t hit over the past several years is the AT-ST Raider.

For some reason LEGO made a billion of them and Amazon has yet to sell out of them to this day.

Look at some of the returns from these sets… insane!

Stranger Things

Average ROI After Selling Fees: 100.0%

Nothing to say. No one is surprised.

Technic

Average ROI After Selling Fees: 59.7%

Solid performance here as usual.

Overall Performance

Overall Average Return on Investment After Selling Fees for All 2021 Retiring Sets: 58.4%

If you blindly invested $100,000 at the end of 2021 into retiring LEGO sets equally, you’d now have $158,400 after selling fees.

If you blindly invested $100,000 into the S&P 500 at the end of 2021, you’d now have $86,382.

I’m not saying one is better than the other… but damn. (just kidding, that’s exactly what I’m saying)

That being said, just because something happened in the past, doesn’t mean it’s going to happen in the future.

I just like sharing my research with like-minded individuals who want to use the power of the internet to escape the rat race before they are too old to enjoy their freedom.

If that is you, thank you for being here.

Until next time.

When you are ready, there are two different ways I can help you:

If you are interested in starting an efficient one-person online business, I recommend starting with one of the following:

Textbook Flipping Mastery - My in-depth guide on how to start a high-margin Amazon e-commerce business.

LEGO Investing Mastery - My in-depth guide on how to start a long-term “buy, hold, and sell” LEGO investing business.

The Conference Room - My private mentorship community that includes the two guides above, for free. Pay once and stay a member for life.

If you are interested following along with my personal LEGO investment portfolio and getting exclusive alerts when I add a new set to that portfolio:

Become a paid subscriber here (7-day free trial available)

These posts are not financial or investment advice.

They are made for entertainment purposes only by a bum who gave up his job as a prestigious Aerospace Engineer to talk about parking money in things like LEGOs.

Thanks for this article. Just checked randomly 2 sets from your list and I can see that what you call current price seems more to be the best price for which you can sell the set. So wondering if I buy e.g. 100 pcs what would be liquidity for that maximum price.......

https://www.brickeconomy.com/set/71705-1/lego-ninjago-legacy-destinys-bounty

https://www.brickeconomy.com/set/76895-1/lego-speed-champions-ferrari-f8-tributo