Analyzing the Investment Returns of Retired LEGO Sets from 2022 After 120 Days

I'm trying to let my personality bleed into my writing... let me know what you think.

This post is brought to you by me. If you want to learn how to get started with LEGO investing, look no further than my LEGO Investing Mastery guide.

In just 90 minutes, it will teach you how to outperform the stock market by buying, holding, and selling sealed boxes of LEGOs.

Get access to it here.

We are now four months removed from a number of LEGO sets having retired at the end of 2022, which means it is time for another performance update.

What is the point of these posts you ask?

To show you how great LEGOs are as investments. If you invest but ignore LEGOs, you hate money.

I’m not joking.

As we move through this update, you’ll notice that the violent price swings are gone and we now have a mix of profit taking and slow melt-ups in price.

Be sure to read the previous analysis here from last month if you have not already.

Let’s take a look.

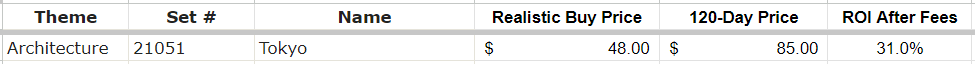

Architecture

Average ROI After Selling Fees: 31.0% (unchanged)

Yeah, nothing happened. Supply is perfectly matching demand for now.

City

Average ROI After Selling Fees: 13.8% (unchanged)

A few sets have grown in value, while a few have dipped as sellers take profit.

Creator

Average ROI After Selling Fees: 21.9% (up from 21.4%)

The Wild Lion is the only set that isn’t profitable in the Creator theme. Color me impressed.

DC

Average ROI After Selling Fees: 20.5% (down from 20.7%)

Almost no change here, like the previous three themes.

Disney

Average ROI After Selling Fees: 29.1% (down from 33.8%)

More profit taking which has caused the ROI to drop. Still a solid performance overall.

DUPLO

Average ROI After Selling Fees: 22.1% (down from 23.6%)

LEGO did us dirty with DUPLO this year. They made too many of several sets.

The day that the Jurassic and Spider man sets finally go out of stock on Amazon, will be a great day.

Friends

Average ROI After Selling Fees: 18.4% (down from 20.7%)

Looks like more profit taking here.

Most sellers don’t have the patience to hold long term or they foolishly used debt to create their positions.

That’s fine, more money for us in the long run.

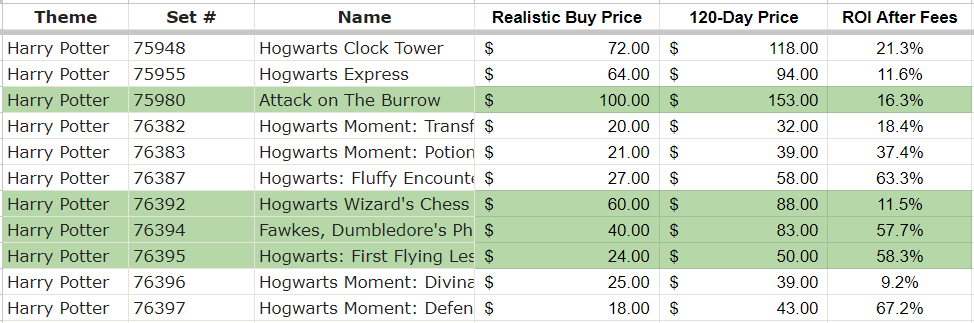

Harry Potter

Average ROI After Selling Fees: 33.8% (down from 37.2%)

Despite the dip back to where we were at the end of February, every set remains in profit.

You’re probably noticing a pattern here. Most themes haven’t grown or are losing a little bit of value as the Timmy’s offload their inventory for microscopic gains.

Holiday

Average ROI After Selling Fees: 27.1% (down from 30.8%)

The pattern continues.

Icons

Average ROI After Selling Fees: 19.5% (up from 18.0%)

Look at that! A little bit of growth. Camper Van prices have rebounded a little as sellers dump their stock.

They will be at $300/set soon and everyone who sold early will be upset or act like they had no other choice.

Ideas

Average ROI After Selling Fees: 27.8% (down from 23.4%)

Another bounce! If LEGO hadn’t made a bunch more of the Central Perk sets prior to retirement, this theme would be crushing right now.

They’ll sell out soon enough though.

Jurassic World

Average ROI After Selling Fees: -3.3% (down from 3.3%)

Right when I thought this theme was headed in the right direction, it falls flat.

Stop making so many of these sets LEGO.

Mario

Average ROI After Selling Fees: 13.9% (up from 11.7%)

Slow and steady growth here somehow. Let’s see if it continues.

Marvel

Average ROI After Selling Fees: 1.5% (down from 3.3%)

The only part of Marvel that has any sort of promise is Spider Man. Everything else is a waste of plastic.

Minecraft

Average ROI After Selling Fees: 13.1% (up from 11.8%)

Minecraft is performing almost identical to the Super Mario theme. I don’t know why or if it is coincidence, but it’s interesting.

Minions

Average ROI After Selling Fees: 39.7% (up from 36.9%)

Go look at all the YouTube videos out there that were predicting which themes were best for the 2022 retiring class.

I know some of those creators read these posts. (You thought I didn’t notice?)

Not a single one of them was talking about the Minions theme. Why? Because most of them don’t do actual research.

I told everyone ahead of time it was one of my favorites but said I didn’t like the Kung Fu Battle Set.

The other two are heavy parts of my portfolio.

Enough said.

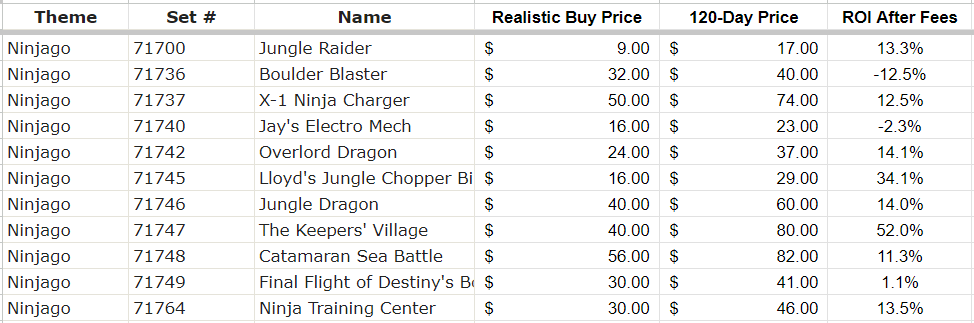

NINJAGO

Average ROI After Selling Fees: 13.7% (up from 12.6%)

Add NINJAGO into that group with Mario and Minecraft. Three themes that are all performing terrible, but are experiencing slow growth recently.

Speed Champions

Average ROI After Selling Fees: 19.4% (up from 9.5%)

Would you look at that… I now have to start respecting this theme. I have been mentioning how overrated it was in 2022, but now it is trying to make me look foolish.

The Corvette set (the only one I own from this list) has bounced hard now that Amazon is out of stock.

Let’s see if it holds up.

Star Wars

Average ROI After Selling Fees: 42.1% (up from 37.1%)

Star Wars is crazy because everyone knows that it’s one of the best themes for investing, yet it still performs.

That means there is a TON of demand.

Every set that retired in 2022 is profitable, with the Mandalorian Forge (Target exclusive) topping the list at over 100% ROI right now.

Technic

Average ROI After Selling Fees: 43.9% (up from 37.1%)

Technic is my favorite theme for a reason: it performs. It has the highest ROI out of any theme and doesn’t look like it’s going to stop this trend.

Every set in this theme that retired in 2022 is in profit.

Overall Performance

The Overall Average Return on Investment After Selling Fees for All Sets: 20.6% (up from 20.4%)

Not much growth month on month, but it’s growth.

Let’s compare it to a few other assets:

S&P 500 YTD: +6.20%

Gold YTD: +9.60%

My Personal LEGO Portfolio: +42.1%

If you blindly bought LEGOs or used my strategy for LEGO investing last year, you’d be beating almost every other investment asset this year by a landslide.

Will it always be this way? Who knows.

However, they’ve outperformed just about everything for decades.

I expect barely any growth as we head into the summer. Timmy and his pals (for the uninitiated, this is code for the “guy/gal who makes decisions with emotion rather than logic”) will continue to sell their entire inventory because they bought more than they could afford.

This will hold prices down until they leave the market.

The explosive growth for 2022 sets will come in the fourth quarter. This is when I plan to offload most of what I have in the portfolio.

Many sets will return 100%-200% ROI, like usual.

When you are ready, there are two different ways I can help you:

If you are interested in starting an efficient one-person online business, I recommend starting with one of the following:

Textbook Flipping Mastery - My in-depth guide on how to start a high-margin Amazon e-commerce business.

LEGO Investing Mastery - My in-depth guide on how to start a long-term “buy, hold, and sell” LEGO investing business.

The Conference Room - My private mentorship community that includes the two guides above, for free. Pay once and stay a member for life.

If you are interested following along with my personal LEGO investment portfolio and getting exclusive alerts when I add a new set to that portfolio:

Become a paid subscriber here (7-day free trial available)

These posts are not financial or investment advice.

They are made for entertainment purposes only by a bum who gave up his job as a prestigious Aerospace Engineer to talk about investing capital in things like LEGOs.

Hi Jarry, I don't see Ninjago 71755 on your list for 2022. Any thoughts on that one? I guess it retired mid year as opposed to December.