Analyzing the Investment Returns of Retired LEGO Sets from 2021 After 15 Months

A look back at how much money you would have made if you invested in LEGOs at the end of 2021.

This post is brought to you by me. If you want to learn how to get started with LEGO investing, look no further than my LEGO Investing Mastery guide.

In just 90 minutes, it will teach you how to outperform the stock market by buying, holding, and selling sealed boxes of LEGOs.

Get access to it here.

Every month, I publish an update on my personal LEGO investment portfolio inside this newsletter.

I also document the performance of LEGO sets post retirement. (Click here for the latest analysis for sets that retired in 2022)

What I have not done for a long time is present the performance of LEGO sets that retired at the end of 2021.

Now that they have been retired for just over 15 months, we have a ton of great data to look back on.

I may start posting about this monthly or space them out, I haven’t decided yet.

Reminder: The data does not include every set that retired in 2021. Only sets that have a listing on Amazon and sets that you could have bought considerable amount of.

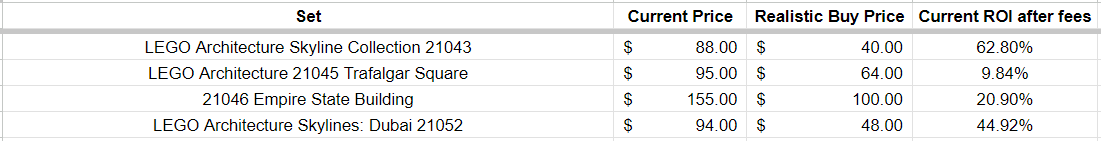

Architecture

Average ROI After Selling Fees: 34.6%

This isn’t much higher than the average for 2022 and is pretty mellow vs. other themes.

City

Average ROI After Selling Fees: 48.1%

This is what you would expect for most City themed sets 15 months after retirement.

Creator

Average ROI After Selling Fees: 36.3%

You’d think this set would have returned more by now. It actually hasn’t really moved up in price since retiring.

DC

Average ROI After Selling Fees: 50.7%

Pretty solid for a super hero theme.

Disney

Average ROI After Selling Fees: 27.6%

Not great, this is why I avoid most Disney sets.

Friends

Average ROI After Selling Fees: 51.2%

Pretty typical stuff here. Nothing to focus on.

Harry Potter

Average ROI After Selling Fees: 66.4%

No one should be surprised to see Harry Potter perform this well. It’s always a solid play due to the demand.

Ideas

Average ROI After Selling Fees: 53.2%

Can’t go wrong with the Ideas theme.

Jurassic World

Average ROI After Selling Fees: 31.4%

The underperformance of Jurassic World extends back further than most people think. I don’t expect this to change until LEGO cuts supply on them.

Mario

Average ROI After Selling Fees: 38.8%

Not bad but nothing to write home about.

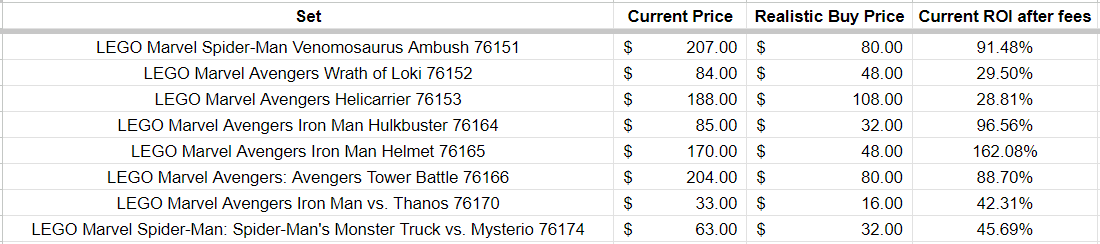

Marvel

Average ROI After Selling Fees: 73.1%

This is the most shocking part of this analysis. Part of it is the Iron Man helmet, but the these is still performing well for 2021 retiring sets.

I believe it is an outlier.

Minecraft

Average ROI After Selling Fees: 43.9%

Minecraft returns will continue to stay lackluster until LEGO reduces supply on it, just like Jurassic World.

Minions

Average ROI After Selling Fees: 89.8%

I look like a genius every time we look at Minions sets. They are amazing.

NINJAGO

Average ROI After Selling Fees: 57.9%

I’d have guessed NINJAGO was performing worse than this. It’s a set that does take time if you want to see great results.

Speed Champions

Average ROI After Selling Fees: 125.2%

See why everyone fell in love with Speed Champions? This is a classic example of skating to the puck instead of skating to where it will end up.

Everyone thought all future Speed Champions sets would be a gold mine.

Guess what? They aren’t. (They will be, it will just take a lot longer than people expect)

Star Wars

Average ROI After Selling Fees: 84.7%

Star Wars and Harry Potter are quite similar. They both perform above average and are a great place to start if you are a beginner.

Stranger Things

Average ROI After Selling Fees: 100.0%

This was a no brainer investment.

Technic

Average ROI After Selling Fees: 56.6%

There is a set or two here that are really holding this theme back for the 2021 retiring class. Other than that, it’s great performance.

Overall Performance

The Overall Average Return on Investment After Selling Fees for All 2021 Retiring Sets: 61.8%

If you blindly invested $100,000 at the end of 2021 into retiring LEGO sets equally, you’d now have $161,800 after selling fees.

If you blindly invested $100,000 into the S&P 500 at the end of 2021, you’d now have $86,344.

Need I say more?

What you will also notice when you compare this data to the ongoing 2022 analysis is that early after retirement, more expensive sets outperform inexpensive sets.

Over time, that trend reverses with cheaper sets outperforming more expensive sets.

The key to outperforming the average return of the LEGO market is knowing which sets to target and which sets to avoid.

All of which I teach inside LEGO Investing Mastery.

Have a question? Leave it below.

When you are ready, there are two different ways I can help you:

If you are interested in starting an efficient one-person online business, I recommend starting with one of the following:

Textbook Flipping Mastery - My in-depth guide on how to start a high-margin Amazon e-commerce business.

LEGO Investing Mastery - My in-depth guide on how to start a long-term “buy, hold, and sell” LEGO investing business.

The Conference Room - My private mentorship community that includes the two guides above, for free. Pay once and stay a member for life.

If you are interested following along with my personal LEGO investment portfolio and getting exclusive alerts when I add a new set to that portfolio:

Become a paid subscriber here (7-day free trial available)

These posts are not financial or investment advice.

They are made for entertainment purposes only by a bum who gave up his job as a prestigious Aerospace Engineer to talk about parking money in things like LEGOs.