TIE #057: The Road to $100,000 with Rakuten + American Express - May 2024

Watch me show you how to create 6 figures out of thin air.

Apparently you hate money. If you didn’t, you’d be using Rakuten every time you shop on websites like Walmart and Target to save money.

They have paid me over $13,943 for things I was already going to buy for my one-person business:

They are also the reason this post is free to read. Sign up here and get $30 for free after your first use.

Rakuten isn’t just a newsletter sponsor, they are an important part of my one-person business that I’ve used for years.

The goal of this series is to hit $100,000 in a brokerage account as a byproduct simply spending money.

You can read the last post here:

I know it probably sounds insane and will likely take a while but I don’t care.

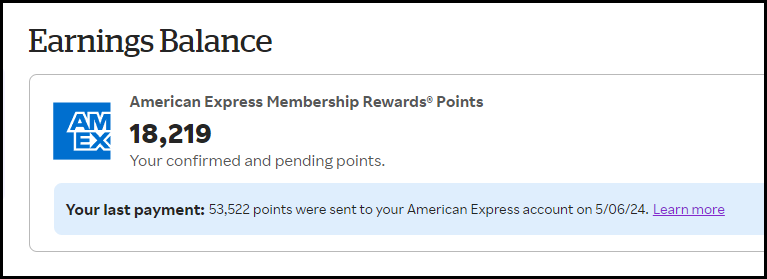

Let’s take a look at our Rakuten earnings:

Total Unpaid Points: 18,219 (Down from 65,464 due to a payout)

Cash Value: $200.41

Over the last month we didn’t earn all that much via Rakuten.

A touch over 6,000 points maybe?

As I mentioned in the previous update, this balance sits pretty stagnant for the first 9 months of the year.

I don’t do a ton of buying on the websites that pay out heavily (perhaps I should change that?).

Now let’s look at our American Express rewards balance:

Total Rewards Points: 139

Cash Value: $1.53

This thing is empty because I made a transfer over to the brokerage account prior to writing this.

Our 80,000 sign up bonus for the Schwab Platinum card should be on the way shortly which will be a free $880 as well.

After taking a hit last month, the brokerage account is looking healthy again:

Total Value: $5,627.02 (+$1,130.32)

Total Cash Value (all of the above): $5,828.96 (+$591.33)

We are looking at a monthly gain of nearly $600 all thanks to cash back and account appreciation.

$600/month isn’t enough to get us to $100,000 anytime soon but again please keep in mind that:

This is the slowest time of year for purchase activity for my business

I could be manufacturing spend but I have been lazy

I use other cards for things I am buying that don’t apply to this venture

When I buy something on Amazon for my business, I use an American Express Business Prime card.

That provides 5% cash back towards Amazon but cannot transfer these points to Schwab (this sucks because I spend a lot on Amazon).

Should I start putting that spend on a 2% cash back American Express card?

I would take an up-front hit but gain in the long by adding it to the brokerage (assuming at least 5% annual ROI).

Let me know what you think with a comment down below.

Thank you for your patience while we get this series up to speed, it is going to take a while to snowball but once it does the progress will be immense.

When you are ready, there is one way I can help you:

The Conference Room: Join 700+ members inside my private mentorship group.

You will learn how to make your first $1,000 on the internet using the same methods I used to escape the rat race.

I figured i was missing something

I am thinking if it was me and I got 5% towards Amazon purchases, which I used to invest in legos, on which I (you) get a 40 - 60 % return, it makes more sense to keep it is is. If you switched and only gained 2% which you then put in the Brokerage account , hoping to get 5 to maybe 10% return, that would not come close to what you are doing now. I get it for purposes of this new branch of the newsletter but seems to me you should stick as is purely from a return standpoint.